It rained for three days straight.

I wasn’t worried. I live on a hill. I’m not near the ocean. I don’t have a river in my backyard. I assumed “floods” were things that happened to people in hurricane zones or beach towns.

But on the third night, the storm drains in our street got clogged with leaves. The water had nowhere to go. It started pooling in the street, then the driveway, and finally, it found the path of least resistance: my basement window wells.

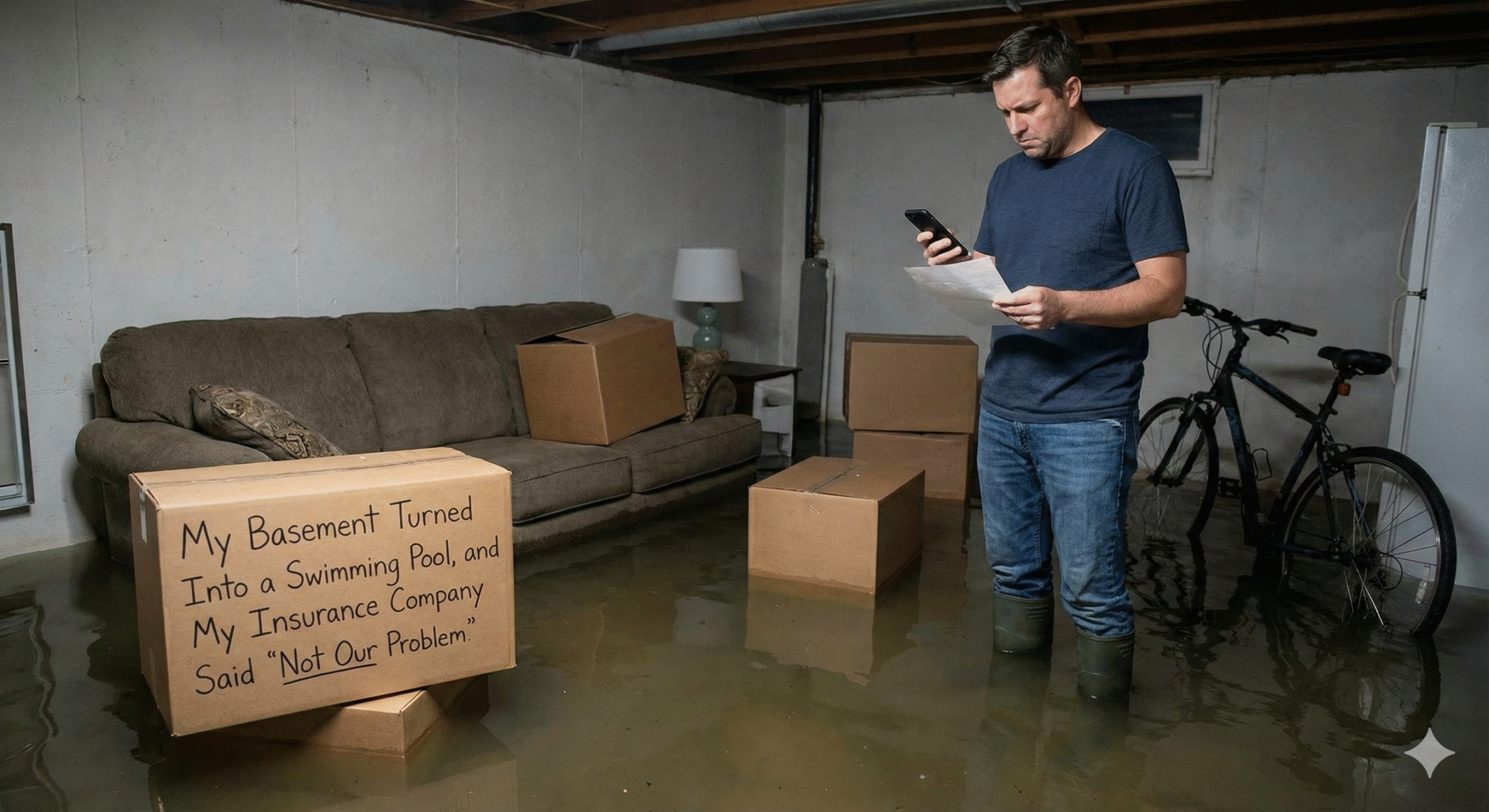

I woke up to the smell of wet carpet. I ran downstairs and stepped into six inches of muddy, brown water. My home office, my kids’ playroom, and boxes of family photos were floating.

I was devastated, but I wasn’t panicked about the money. “I have the best Homeowners Insurance money can buy,” I told my wife. “I pay premium rates. They’ll cover this.”

I called my agent at 8:00 AM. By 8:05 AM, I learned the most expensive lesson of my life: Standard Homeowners Insurance does NOT cover floods.

Here is the difference between “Falling Water” and “Rising Water,” and why your policy might be useless when the rain starts.

The “Rising Water” Rule

The claims adjuster explained it to me in a way that made me want to scream.

-

Falling Water (Covered): If a storm blows a hole in your roof and rain pours in, that is covered. If a pipe bursts in your wall—like my story about [Water Damage] in the kitchen—that is covered.

-

Rising Water (Not Covered): Once the water touches the ground outside and then enters your home, it is classified as a “Flood.”

It doesn’t matter if it’s a hurricane, a river overflowing, or just a clogged sewer drain in the street (like my case). If the water comes from the ground up, your standard policy pays $0.

I had $20,000 worth of damage. My payout was $0.

“But I’m Not in a Flood Zone!”

This was my main argument. I pulled up the FEMA maps. My house is in “Zone X” (Minimal Flood Hazard).

The adjuster sighed. “Sir, 25% of all flood claims come from low-risk zones.”

Being in a “Low Risk” zone doesn’t mean “No Risk.” It just means the government doesn’t force you to buy insurance. Because I listened to the map instead of common sense, I was unprotected.

If you live anywhere that it rains, you live in a flood zone.

The “Sewer Backup” Loophole

Here is where it gets even trickier.

Sometimes, water comes up through your drains or toilets because the city sewer system is overwhelmed. This isn’t technically a “surface flood,” but it is also excluded from standard policies.

To be covered for this, you need a specific “Rider” (Add-on) called Water Backup and Sump Pump Failure.

-

Cost of Rider: About $50 a year.

-

Cost of Cleanup: $10,000+.

I didn’t have this rider either. I realized I had left my biggest asset (my home) completely exposed to water, despite paying thousands a year in premiums.

How I Fixed My Coverage (The FEMA vs. Private Debate)

After draining my savings account to fix the basement, I vowed never to be in this position again. I went shopping for Flood Insurance.

You generally have two options:

1. The Government Plan (NFIP)

The National Flood Insurance Program is run by FEMA.

-

Pros: They can’t deny you coverage based on risk.

-

Cons: It is capped. They usually only cover up to $250,000 for the house and $100,000 for contents. If you have a finished basement, their coverage is very limited (they often won’t pay for the drywall or carpet in a basement, only the furnace).

2. Private Flood Insurance

This is what I chose. Private companies are starting to offer their own flood plans.

-

Pros: They often offer higher limits (up to $500k or $1M) and—crucially—they often cover “Loss of Use” (paying for a hotel while your house is wet).

-

Cons: They can drop you if they decide your area is too risky.

3 Steps to Check Your Risk Today

Don’t wait for the rain to start. Do this now:

-

Check Your Policy for “Water Backup”: Look at your Declarations Page. Do you see a line item for “Water Backup of Sewers or Drains”? If not, call your agent and add it. It is cheap.

-

Ignore the “Zone”: Don’t ask “Am I in a flood zone?” Ask “If it rains 10 inches in one day, where does the water go?” If your driveway slopes toward your house, you are at risk.

-

Inventory Your Basement: Just like I advised in my article about [Renters Insurance] and burglary, keep a digital list of what is in your basement. If a flood happens, water turns everything into mush. You won’t be able to identify what books or electronics you lost. Take photos now.

Conclusion: The “Act of God” is on You

Insurance companies love to use the term “Act of God” to avoid paying claims. But protecting your home is an “Act of Preparation.”

A standalone Flood Insurance policy for a low-risk zone can cost as little as $400 a year. I paid $20,000 out of pocket because I wanted to save that $400.

Don’t make my math mistake. If water can enter your home, you need a policy that explicitly says the word “FLOOD.”