There is a specific kind of pain that makes you irrational. A toothache is one of them.

Last year, I woke up with a throbbing pain in my lower molar. It felt like a heartbeat in my jaw. I knew what it meant: Root Canal.

I immediately panicked about the cost. I didn’t have dental insurance. I did a quick Google search and found a plan for $40 a month. I thought I was a genius. “I’ll sign up today, pay the $40, and let them cover the $2,000 surgery next week.”

I signed the papers, went to the dentist, got the root canal, and handed the receptionist my shiny new insurance card.

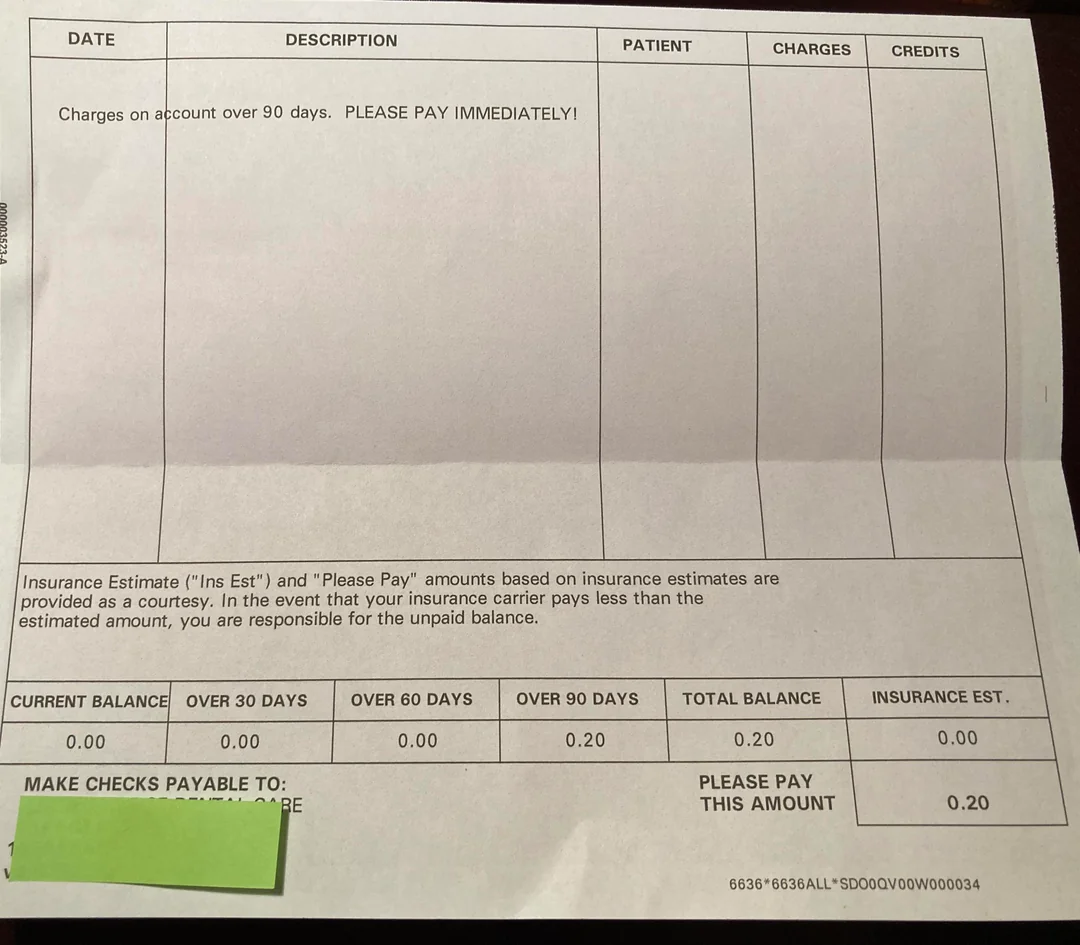

A week later, I got the bill. Total Cost: $2,200. Insurance Paid: $0. You Owe: $2,200.

I called the insurance company, furious. “I have a policy!” I yelled. The agent calmly told me to look at Page 4, Section C of my contract: The Waiting Period.

Here is the hard lesson I learned about why Dental Insurance is completely different from regular Health Insurance.

The “12-Month Rule” You Didn’t Read

Medical insurance is legally required to cover you immediately for emergencies. Dental insurance is not.

Dental insurance is treated more like a “Discount Club” than true insurance. To prevent people like me—who only buy insurance when they are already hurt—companies enforce Waiting Periods.

-

Preventative (Cleanings/X-Rays): Covered immediately (Day 1).

-

Basic (Fillings): Usually a 6-month wait.

-

Major (Root Canals/Crowns/Bridges): Usually a 12-month wait.

Because I needed “Major” work done 3 days after buying the policy, I was in the blackout period. I had paid the premium for nothing.

The “Annual Maximum” Shock

Even if I had waited 12 months, I learned another nasty truth about dental plans: The Annual Maximum.

With your [Health Insurance], once you hit your deductible, the insurance pays for almost everything (even if it costs $1 million). Dental insurance is the opposite. They have a “Cap.”

Most plans cap out at $1,500 per year.

-

My Root Canal + Crown cost: $2,200.

-

Max Insurance Payout (Best Case): $1,500.

-

I would still have to pay $700 out of pocket.

This made me realize: Dental insurance isn’t designed for catastrophic events. It is designed to help with maintenance.

Is It Ever Worth It? (My New Strategy)

After swallowing that $2,200 bill, I sat down and did the math. Is dental insurance ever worth buying?

Yes, but ONLY if you do the math:

-

The Cost: $40/month x 12 months = $480/year.

-

The Benefit: Two cleanings ($200) + One set of X-Rays ($150) = $350 value.

If you have perfect teeth, you actually lose money buying insurance ($480 cost vs $350 value). However, if you need just one filling ($300), the math flips in your favor.

My Rule: I now treat dental insurance like a subscription service for cleanings. I don’t expect it to save me from a disaster. For disasters, I rely on my Emergency Fund.

How to Get Discounts Without Insurance

If you are currently staring at a huge dental bill and don’t have insurance, don’t give up. I learned there is a “secret menu” price.

I asked my dentist: “I am paying cash. I don’t have insurance. Can you give me a discount?”

Because they didn’t have to deal with the paperwork and waiting for the insurance company check, they instantly knocked 15% off the bill.

Just like I learned when asking about [Hidden Health Insurance Discounts], simply asking the question can save you hundreds of dollars.

Conclusion: Don’t Buy It in an Emergency

If your tooth already hurts, it is too late. The insurance company knows the game better than you do.

-

If you have healthy teeth: Negotiate a cash price for your cleanings.

-

If you have bad teeth: Buy the insurance NOW and wait out the 12-month clock so you are ready for next year.

Don’t be like me. Don’t try to outsmart the system while your face is swollen.