I still remember the sinking feeling in my stomach when I opened the envelope.

I had been driving for ten years without a single accident. Then, one rainy Tuesday, a distracted driver rear-ended me at a stoplight. It seemed open-and-shut. I filed my claim, took photos, and waited for the check to repair my bumper.

Two weeks later, the letter arrived. It wasn’t a check. It was a single page with the word DENIED in bold letters.

I felt betrayed. I paid my premiums every month on time. Why was my insurance company abandoning me when I actually needed them?

If you are reading this, you probably have that same letter in your hand. You feel angry and helpless. I want to tell you: do not give up.

It took me three weeks of stress and paperwork, but I fought that denial and I got my payout. Here is exactly how I did it, and the mistakes I learned to avoid along the way.

The “Oh No” Moment: Understanding Why They Said No

The biggest mistake I almost made was ripping up the letter in anger. Don’t do that.

When I calmed down, I read the letter again. Insurance companies rarely say “No” just to be mean; they say “No” based on technicalities. In my case, they claimed there was a “discrepancy in the accident timeline.” Essentially, they thought I filed the claim too late.

To win, you have to know exactly what you are fighting. Look for the “Reason Code” in your letter. Is it:

-

Lapsed Coverage? (Did a payment bounce?)

-

Driver Exclusion? (Was someone else driving your car?)

-

Avoidable Accident? (Do they think it was your fault?)

Once I identified their reason, I knew exactly what evidence I needed to find to prove them wrong.

Step 1: I Dug Out My “Declarations Page”

I’ll be honest—I had never actually read my insurance policy. It was just a PDF sitting in my email inbox.

I opened it up and looked for the “Declarations Page.” This is the summary of what you are actually paying for. I realized that my policy had a “grace period” for reporting accidents that I was well within.

My advice to you: Compare the reason in their denial letter to the wording in your contract. If the contract says you have 30 days to report an accident, and they denied you on day 15, you have already won the argument.

Step 2: Gathering My “War Folder” (Evidence)

I realized that arguing with the customer service agent on the phone was useless. The person on the phone doesn’t have the power to write checks. I needed to build a case that a supervisor couldn’t ignore.

I created a folder on my desktop and gathered everything:

-

The Police Report (FIR): This was my “smoking gun.” The police report clearly stated the date and time of the accident, proving I reported it immediately.

-

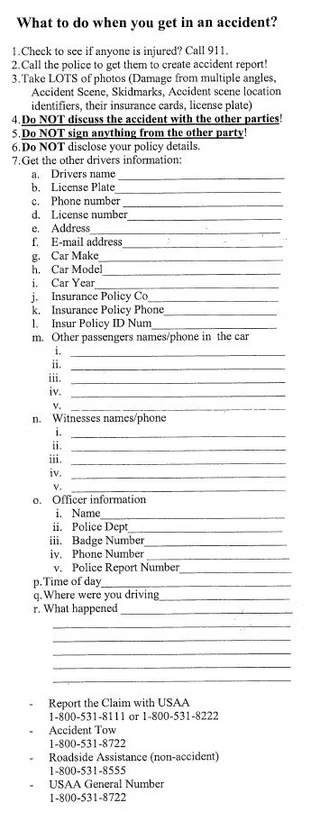

Photos: I had taken photos of the other driver’s license plate and the damage at the scene. ( Tip: Never rely on the other driver’s promise to pay. Always take photos. )

-

Call Logs: I took screenshots of my call history showing I called the insurance hotline 20 minutes after the crash.

Step 3: Writing the Appeal Letter (The Script I Used)

I didn’t send a nasty email. I wrote a formal business letter. I wanted to sound professional, not emotional.

Here is the structure I used. Feel free to copy this for yourself:

Subject: Formal Appeal for Claim #[Your Claim Number]

To the Claims Department,

I am writing to formally appeal the denial of my claim regarding the accident on [Date].

Your denial letter states that [Insert Their Reason, e.g., I failed to report the accident in time]. However, this is incorrect based on the evidence attached.

Exhibit A: Attached is the Police Report filed on [Date], which proves the timeline of the incident. Exhibit B: Attached are screenshots of my call logs to your agency on the day of the accident.

Based on my policy terms (Section X, Page Y), I am fully covered for this incident. I request that you review this new evidence and process the payment for repairs immediately.

Sincerely, [Your Name]

I sent this via email and certified mail. I wanted proof they received it.

Step 4: The Waiting Game (And When to Escalate)

For five days, I heard nothing. Silence.

I called them back. The agent tried to brush me off, saying “It’s under review.” This is where I learned to be pushy but polite.

I asked: “Can I speak to the Claims Supervisor, please? I have sent certified evidence that contradicts your denial letter, and I would hate to have to file a complaint with the State Insurance Ombudsman.”

Mentioning the Ombudsman changed the tone of the conversation immediately. Suddenly, I was transferred to a manager.

The Outcome: Victory

Two days after speaking to the supervisor, I got an email. It didn’t apologize—insurance companies rarely do—but it said: “Upon further review, your claim has been approved.”

The check for the repairs arrived a week later.

Key Takeaways from My Experience

If you are going through this right now, here is what I want you to know:

-

They expect you to give up. They bank on you being too tired or busy to fight. Don’t let them win.

-

Paperwork is power. Your memory of the accident doesn’t matter. Only what you can prove on paper matters.

-

Stay calm. Yelling feels good, but writing a clear, evidence-based letter gets you paid.

It wasn’t easy, and it definitely wasn’t fun. But getting that denial overturned saved me thousands of dollars. If I can do it, you can too.