It was a rainy Tuesday. I was driving home from work, listening to a podcast, when the car in front of me slammed on its brakes.

I reacted a split-second too late. Crunch.

Airbags deployed. Steam rose from the hood. I was shaken but unhurt. As I watched the tow truck drag my beloved 18-month-old sedan away, I thought, “Well, this sucks, but at least I have ‘Full Coverage.’ The insurance will pay off the loan, and I’ll get a fresh start.”

I was wrong.

Three weeks later, I received two letters in the mail on the same day.

-

Letter from Insurance: “We have deemed your vehicle a total loss. Based on the market value, we are issuing a payout of $18,000.”

-

Letter from the Bank: “The remaining balance on your auto loan is $23,000.”

I stared at the papers. The math didn’t make sense. $23,000 (Loan) – $18,000 (Payout) = $5,000.

I didn’t just lose my car. I now owed the bank $5,000 for a pile of scrap metal that was sitting in a junkyard.

This is the nightmare of Negative Equity, and it happened because I didn’t understand “Gap Insurance.”

The “Depreciation” Trap

Here is the secret car dealers don’t emphasize when you sign the papers: New cars lose value faster than you pay off the loan.

When I bought the car, I put $0 down and stretched the loan to 72 months to keep the payments low.

-

Day 1: I drove off the lot. The car instantly lost 20% of its value (Depreciation).

-

Year 1: I was making small payments, mostly paying off interest, not the principal.

By the time I crashed, the car was worth far less than the loan balance. My standard insurance policy only promised to pay the “Actual Cash Value” (what the car is worth today), not what I promised to pay the bank.

How “Gap Insurance” Would Have Saved Me

If I had checked one little box on my policy called Guaranteed Asset Protection (GAP), the story would have been different.

Gap Insurance is designed specifically for this “Gap.” It pays the difference between the insurance payout and the loan balance.

-

My Reality: I had to take out a personal loan for $5,000 just to pay off the wrecked car. I was making payments on a “ghost car” for two years.

-

With Gap Insurance: The insurance company would have paid the $18,000 plus the extra $5,000. I would have walked away with $0 debt.

3 Signs You Absolutely Need Gap Insurance

I learned my lesson the hard way. Now, I never buy a car without asking myself these three questions. If you answer “Yes” to any of them, you need Gap coverage.

1. Did you put less than 20% down?

If you put $0 down or a small down payment, you are almost certainly “upside-down” on your loan the moment you drive away. You have no equity cushion.

2. Is your loan term longer than 60 months?

Long loans (72 or 84 months) lower your monthly payment, but they also mean you build equity very slowly. You will owe more than the car is worth for years.

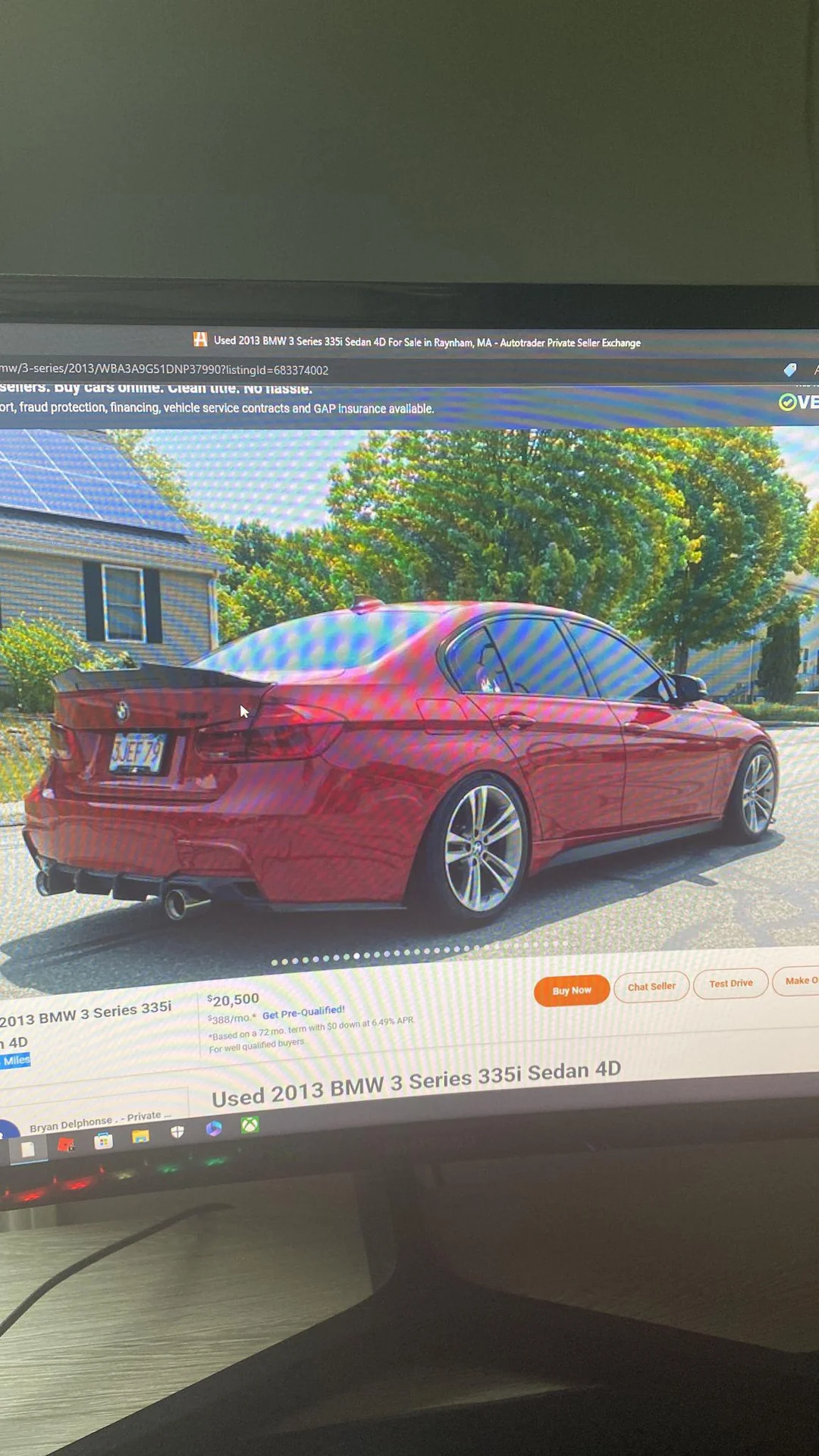

3. Did you buy a luxury car?

BMWs and Audis depreciate like a stone falling off a cliff. A Toyota maintains its value better. If you drive a luxury car, the “Gap” between value and loan gets wide very fast.

Don’t Buy It From the Dealer! (Pro Tip)

Here is the final insult to injury.

When I bought my replacement car, the dealership Finance Manager tried to sell me Gap Insurance. Dealer Price: $800 (rolled into my loan).

I called my insurance agent instead. Agent Price: $40 per year.

Yes, you read that right. Most auto insurance companies will add Gap coverage to your policy for the price of a nice dinner. Dealers mark it up by 1000% to make a profit.

Conclusion: Do The Math Today

Go check your car loan balance right now. Then, go to Kelly Blue Book and check your car’s trade-in value.

If the Loan is higher than the Value, you are in the danger zone.

Don’t wait for a crash to find out you are broke. Just like I learned with my [Travel Insurance] mistake in Thailand, being “cheap” on premiums often costs you thousands in the end. And remember, if you think fighting a claim is hard, try fighting a bank for a loan on a car that doesn’t exist—it’s even harder than the [Car Insurance Appeal] process I wrote about earlier.