We all think “it won’t happen to me.”

I considered myself a safe driver. I had never had a major accident. I paid my car insurance premiums on time every month. My policy said “Full Coverage,” so I slept soundly at night assuming I was protected against anything.

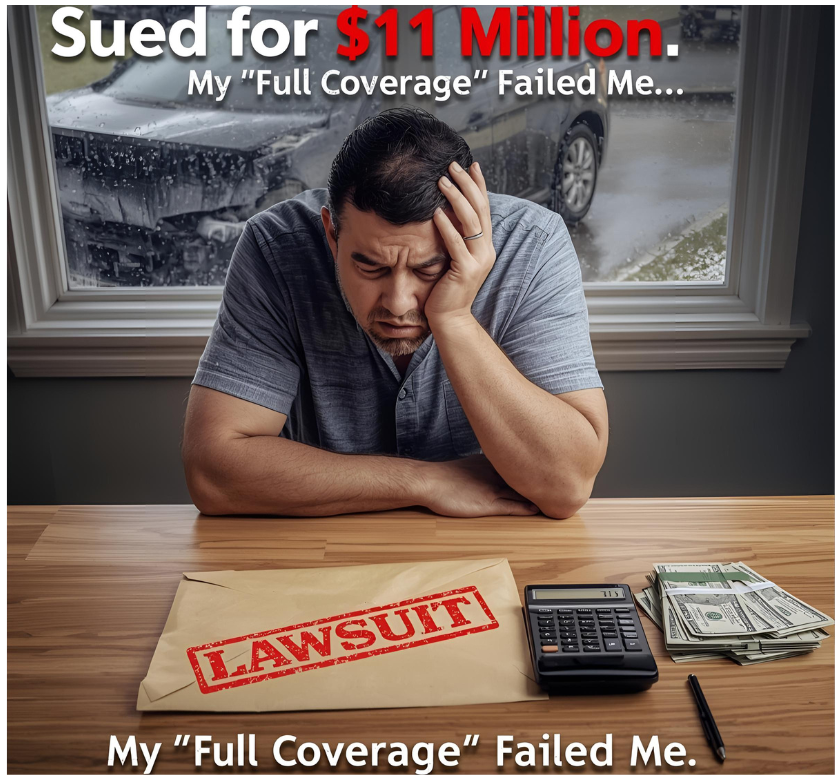

Then came the rainy Tuesday that ruined my financial life.

I looked down at my GPS for two seconds. That was all it took. I rear-ended a luxury SUV at a red light. The damage to the cars looked minor—maybe a few thousand dollars in bumper repairs. I apologized, exchanged info, and thought that was the end of it.

Three months later, a process server knocked on my door and handed me a thick envelope. I was being sued for $1,000,000.

The driver of the other car was a surgeon. The “minor” impact had caused a spinal injury that required surgery and kept him out of work for months. He was suing me for medical bills, pain and suffering, and lost wages.

I called my insurance agent in a panic. “Don’t worry,” I said. “I have full coverage. You guys handle this, right?”

The agent’s voice was quiet. “Sir, your liability limit is $250,000. If the court awards him $1,000,000, the insurance company pays the first $250k. You are personally responsible for the remaining $750,000.”

I felt like I was going to throw up. I didn’t have $750,000. I had a house with a mortgage and a small retirement fund.

“They can go after your assets,” the agent warned. “They can garnish your future wages. They can put a lien on your home.”

This is the nightmare scenario that Umbrella Insurance prevents, and I had never even heard of it.

The Myth of “Full Coverage”

Most people don’t know what their “Limits” actually mean. If your auto policy says 100/300/100, it means:

-

$100,000 for injury to one person.

-

$300,000 total injury per accident.

-

$100,000 for property damage.

In 1990, these numbers were huge. In 2025, with rising medical costs and expensive cars, they are nothing. A single serious hospital stay can burn through $100,000 in three days.

If you cause an accident that exceeds these limits, you pay the rest.

What is Umbrella Insurance?

Umbrella Insurance is exactly what it sounds like: an extra layer of protection that sits over your existing [Auto Insurance] and [Home Insurance] policies.

It kicks in only when your standard liability limits are exhausted.

-

Scenario Without Umbrella:

-

Lawsuit: $1,000,000

-

Auto Insurance Pays: $250,000

-

You Pay: $750,000 (Bankruptcy)

-

-

Scenario With Umbrella:

-

Lawsuit: $1,000,000

-

Auto Insurance Pays: $250,000

-

Umbrella Pays: $750,000

-

You Pay: $0

-

Why Didn’t My Agent Sell Me This?

This made me angry. Why didn’t anyone tell me? The truth is, agents often hesitate to suggest it because they are afraid of “upselling” you. They know you want the cheapest monthly rate. Adding Umbrella coverage adds to the bill, so they skip it to close the sale.

But here is the crazy part: It is incredibly cheap.

Because the odds of a $1 Million lawsuit are low, the premiums are rock bottom. I priced it out after my lawsuit nightmare settled (I eventually settled for less, but it wiped out my savings).

-

Cost for $1,000,000 in coverage: About $150 to $200 per year.

That is less than $20 a month. I was paying more for Netflix than for a policy that would have saved my life savings.

3 Signs You Need an Umbrella Policy Today

You don’t have to be a millionaire to be sued like one. In fact, middle-class people are the biggest targets because we have assets (like a house) but often lack the legal teams to fight back.

You absolutely need Umbrella insurance if:

-

You Own a Home: Your home is your biggest target. If someone slips on your icy driveway or your dog bites a neighbor, they can sue you for the equity in your house.

-

You Have a Teen Driver: As I wrote about in my [Teen Driver Insurance] article, inexperienced drivers are high-risk. One mistake by your 16-year-old could bankrupt the whole family.

-

You Have “Attractive Nuisances”: Do you have a swimming pool? A trampoline? A big dog? These are lawsuit magnets. If a neighborhood kid sneaks into your yard and gets hurt, you are liable.

Conclusion: The Cheapest Sleep You Can Buy

I managed to survive my lawsuit, but it set my retirement back by ten years. I still drive past that intersection and shudder.

Don’t wait for the process server to knock on your door. Call your agent today and ask: “How much would it cost to add a $1 Million Umbrella policy?”

When they tell you it’s only $15 a month, you will wonder why you ever took the risk without it.